“How much do I need for a comfortable retirement?”

Having worked and saved for many years, you might be at the stage when you’re thinking of retiring.

This short blog will help you to understand:

“Can I retire early?”

“How much income do I need in retirement?”

“What’s a good retirement income?”

“How can I track down lost pensions?”

Retiring today is much more complex than it was in the past. The days of having one job for life and a Final Salary pension scheme are, for most people, long gone.

It’s no surprise, then, that one of the most common questions asked by clients seeking pension advice in Bradford on Avon is: How much do I need to retire?

Building up sufficient savings is crucial to ensuring your retirement dreams become reality, whether that’s travelling the world or simply spending more time with your loved ones.

The fact you’re thinking about funding your retirement, already puts you in a stronger position than those who take the ‘bury my head in the sand’ approach. The next step is figuring out exactly how much you need to save.

To help you get started, I’ve highlighted below how much a typical retirement costs, what size of pension pot this requires, and how you can tackle a shortfall. If you would like more information, please don’t hesitate to contact me.

A comfortable retirement costs £25,000 a year

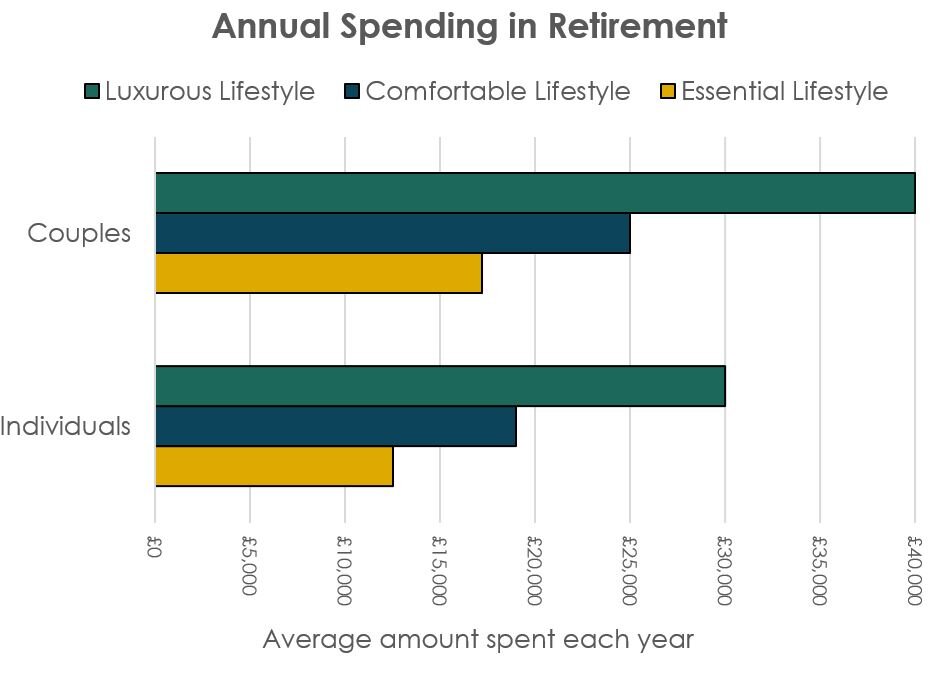

According to a survey of retirees by Which? it costs couples around £25,000 a year to fund a ‘comfortable’ retirement. This includes your day-to-day essentials plus some leisure spending, such as short-haul breaks, regular recreational and leisure activities, alcohol, and charity donations.

If, like many of my clients, you’re aiming for a more luxurious retirement with long-haul holidays, a regular new car, health club memberships and expensive meals out, this would cost couples around £40,000 a year.

Source: Which?

These figures may be lower than your current household earnings, and that’s because many retirees have paid off their mortgage and typically have lower living costs.

Remember, these are average amounts. Your expenses could be higher or lower, depending on how you spend your time when you finish work. You might find your income needs vary throughout retirement, perhaps starting off high as you tick off items on your bucket list, reducing as you get older, and then ramping up again to pay for later-life care.

A financial planner will use cashflow modelling tools to help you figure out what your costs in retirement are likely to be.

Tackle shortfalls sooner rather than later

If you’re worried your pension pot won’t be as big as you’d like it to be, the sooner you act the better. The earlier you start investing, the longer your money will have to benefit from stock market growth.

There are several ways you could tackle a shortfall in your retirement savings.

First, you could consider delaying your retirement. Nowadays, many people take a gradual approach to retirement where they work part-time or on a consultancy basis. By delaying your retirement, your money will have more time to grow and it won’t need to last as long.

If you’re able to, paying more money into your pension could make a big difference to your pot at retirement. Each time you receive a pay rise, it’s worth increasing pension contributions so you don’t fritter away the money on little luxuries.

When you pay into a pension, the government tops it up with 20% tax relief so, for a basic-rate taxpayer, a £1,000 contribution only costs you £800.

Don’t forget your other savings and investments

Even if your pension isn’t as big as you hoped, your overall savings might be sufficient to meet your goals.

Income in retirement doesn’t have to come from pensions. It can come from ISAs and other savings accounts too. So, when you’re working out whether you have enough money to retire, don’t forget to look at all your finances together. You might be surprised at how much interest you’ve amassed in old bank and building society accounts.

If you rent out property or continue to work in retirement, these could also be valuable sources of retirement income.

Finally, make sure you haven’t forgotten any private or workplace pensions. The Association of British Insurers estimates that 1.6 million pension pots have been forgotten about, with an average size of £13,000. You can use the government’s free Pension Tracing Service to track down lost pensions.

If in doubt, seek advice

Working out how much money you need to retire and whether you’re on track to achieve your goals isn’t easy – and that’s where a financial planner can help.

Once I’ve formed a thorough understanding of your situation and priorities, I’ll create a comprehensive financial plan that sets out how you can achieve your retirement, financial and life objectives. I’ll review your situation regularly to ensure your goals are on track.

Knowing your future plans are taken care of can be a real source of comfort as you approach retirement.

Get in touch

If you’re looking for expert pension advice near Bristol and Bath or just want further information, please get in touch. Email daniel@wiltshirewealth.com or call 01225 699790.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested, which would have an impact on the level of pension benefits available.

Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.